Project Acacia; Tokenisation - The Future of Funds Management

A summary of this article is available in audio format on the JellyC Bytes podcast

Introduction: The Shift Toward Tokenised Financial Infrastructure

The global financial system is entering a structural transformation as blockchain technology redefines how value is created, held, and exchanged. Tokenisation, the process of representing ownership of real-world or financial assets as digital tokens on a blockchain, is rapidly becoming one of the most significant advancements in modern finance. It promises to reshape markets by delivering greater transparency, faster operations and accessibility, enabling 24/7 settlement, verifiable ownership, and frictionless liquidity.

Industry projections estimate the global market for tokenised assets will exceed US$16 trillion by 2030, driven by institutional adoption across funds, securities and private markets. In Australia, this evolution is accelerating through active regulatory engagement, including the Reserve Bank of Australia (RBA) and Digital Finance Cooperative Research Centre’s (DFCRC) Central Bank Digital Currency (CBDC) pilot, the Australian Securities and Investment Commission’s (ASIC) tokenisation survey, and the Australian Government Treasury’s digital assets reform agenda.

For fund managers in Australia, tokenisation introduces an opportunity to modernise the unit trust, the foundational structure of Australian investment management, by embedding automation, near-instant settlement, and real-time transparency within a compliant digital registry.

The Australian Context: A Regulatory Framework Ready for Innovation

Australia’s investment ecosystem is built on robust trust law and a regulated managed-fund framework under ASIC and Australian Financial Services License (AFSL) supervision. Wholesale managed investment schemes (MIS) collectively hold several trillion dollars in assets, yet their operations remain constrained by manual workflows: multi-day settlements, reconciliation delays, and fragmented registries.

This architecture creates several inherent limitations:

Fragmented record-keeping: Settlement records remain siloed across registrars, custodians, and fund administrators, necessitating costly reconciliation processes prone to error.

Illiquidity: Wholesale funds traditionally lock investors into long-term structures with limited secondary market access, depressing capital efficiency.

Manual compliance: Know Your Customer (KYC), Anti-Money Laundering (AML), and investor eligibility checks involve repetitive manual verification, creating administrative friction and regulatory risk.

Limited transparency: Investors receive periodic statements rather than real-time visibility into holdings and transactions, impeding informed decision-making.

These constraints are particularly acute for wholesale trusts targeting sophisticated investors who demand institutional-grade efficiency and transparency.

Tokenisation provides a pathway to modernise these systems without compromising regulatory integrity. Under existing frameworks, trust-based fund structures can leverage blockchain infrastructure for issuance, registry, and transfer functions, provided that custody, KYC, and fiduciary obligations remain under AFSL oversight.

Through industry initiatives like Project Acacia, JellyC in partnership with TAF Capital, Tokeniser, Redbelly Network, Macropod, and OpenMarkets, demonstrates how this evolution can be implemented in practice. The result is creating a digital-native, AFSL-compliant wholesale unit trust on an Australian Layer-1 blockchain.

About Project Acacia

Project Acacia is a landmark Australian research initiative exploring how tokenisation and digital money can modernise wholesale financial markets. It represents one of the most comprehensive real-money trials of blockchain-based settlement infrastructure globally. Project Acacia has selected 19 pilot use cases involving real money and real asset transactions. The project's findings on wholesale tokenised asset settlement will directly inform how unit trusts can leverage blockchain infrastructure while maintaining regulatory compliance. Each participant below contributes to a key component of the digital fund lifecycle.

JellyC – Investment manager and project lead, responsible for fund strategy, execution architecture, and investor onboarding.

TAF Capital – Licensed trustee and custodian, holding investors’ AUDM and fund tokens under AFSL authority.

Tokeniser – Hybrid digital registry and issuance platform that synchronises on-chain token records with traditional fund administration.

Redbelly Network – an Australian Layer 1 blockchain designed for institutional-grade tokenization, embedding zero-knowledge identity primitives at the execution layer to enable identity and collateral mobility in regulated DeFi.

Macropod – Issuer of AUDM, a licensed and fully backed Australian-dollar stablecoin enabling fiat-linked settlement.

OpenMarkets – Secondary venue partner enabling post-issuance distribution.

The pilot fund (structured as a single-asset trust on Redbelly Network) demonstrates on-chain issuance and redemption of fund units, registry synchronisation, and stablecoin settlement. Following this proof-of-concept, JellyC will extend the underlying framework to support real-time Net Asset Value (NAV) automation, direct asset execution, and multi-asset portfolios beyond the Acacia pilot scope.

As part of Project Acacia’s 19 pilot transactions, JellyC also participated in the issuance and secondary trading of Australia’s first tokenised corporate bond. Led by Macropod and issued by Imperium Markets on its ASIC-licensed marketplace, the bond was settled on Redbelly Network using AUDM. Barrenjoey Markets purchased the bond in the primary issuance and executed a secondary trade to JellyC. The full cycle (issuance, coupon payment, and secondary transfer) was completed in under four minutes, demonstrating atomic settlement, zero counterparty risk, and automated corporate actions. This use case validated the same infrastructure stack (Redbelly, AUDM, and compliant marketplaces) that JellyC now extends to unit trust tokenisation.

The Technology Framework

Redbelly Network was selected for its deterministic finality (transactions cannot be reversed once confirmed) and performance exceeding 97,000 transactions per second, ensuring scalability for institutional workloads. Unlike most public blockchains, Redbelly supports KYC-verified wallets.

Tokeniser acts as the connective layer between on-chain smart contracts and off-chain fund systems. All unit transactions recorded on Redbelly are mirrored within Tokeniser’s registry interface, maintaining full compliance with the legal unit register and ASIC reporting obligations.

TAF Capital, as trustee, provides custody and key management for all investor wallets and assets, including fund tokens and AUDM. By retaining wallet keys under its AFSL, TAF ensures investors’ digital assets are safeguarded within a regulated fiduciary structure while still maintaining full blockchain transparency.

AUDM, issued by Macropod, provides the on-chain settlement mechanism, ensuring instantaneous, verifiable payment and delivery across all fund transactions.

Real Time NAV, Automated Execution and Liquidity

A core innovation of Project Acacia is its automated execution framework: an integrated system that connects investor orders, blockchain registry events, and the fund’s underlying asset allocation through programmable logic and APIs.

Traditional Management Information System (MIS) operations are based on manual batch processes: investor applications are priced at end-of-day NAV, cash transfers are processed through banks, and portfolio allocations are executed hours or days later. This introduces latency, operational risk, and reconciliation burdens due to the disconnect between investor intent, valuation, and asset execution.

Project Acacia introduces deterministic execution, where each transaction follows a single, verifiable path:

NAV Retrieval and Validation – The current NAV is pulled in real time from Tokeniser’s Real Time NAV engine, which aggregates validated feeds from exchanges, staking protocols, custodians, and off-chain data sources.

Compliance Orchestration – The smart contract checks KYC status, investor limits, and AFSL compliance gates before processing.

Atomic Unit Mint/Burn – On subscription, a mint instruction issues new units exactly equal in value to the investor’s AUDM contribution. On redemption, units are burned, releasing the corresponding AUDM amount.

Synchronous Asset Execution – The orchestration layer simultaneously sends an instruction through JellyC’s integrated execution stack (comprising exchange APIs, custody providers, and staking nodes) to allocate or unwind the matching underlying asset exposure.

Registry Synchronisation and Settlement – Registry balances are updated instantly on both the blockchain and Tokeniser platform, while AUDM settlement finalises within seconds.

This architecture enables on-chain events to directly trigger off-chain asset execution, producing true atomic settlement between units and underlying holdings. There is no temporal mismatch between issuance and asset acquisition; every token minted represents immediate exposure to real assets.

The Role of a Real-Time NAV (RTN)

The Real Time NAV engine underpins price integrity across all processes. Using continuous API aggregation, it recalculates the fund’s net value at sub-minute intervals. Once validated by the trustee, this data feeds both the execution logic and the secondary market pricing oracle, ensuring every trade and issuance reflects a verified, up-to-date value.

Liquidity Through Secondary Markets

Through AUDM-based settlement, fund units can trade seamlessly on secondary venues such as OpenMarkets. Each trade clears in real time, with NAV-linked pricing and immutable audit trails.

Secondary markets introduce intra-day liquidity to traditionally illiquid wholesale trusts. Investors can adjust or exit positions without invoking redemption processes, while all activity remains anchored to the fund’s verified NAV. Over time, market-driven liquidity around NAV will allow fund units to behave similarly to exchange-traded products – yet still governed by a regulated trust structure.

Benefits and Challenges for Tokenisation

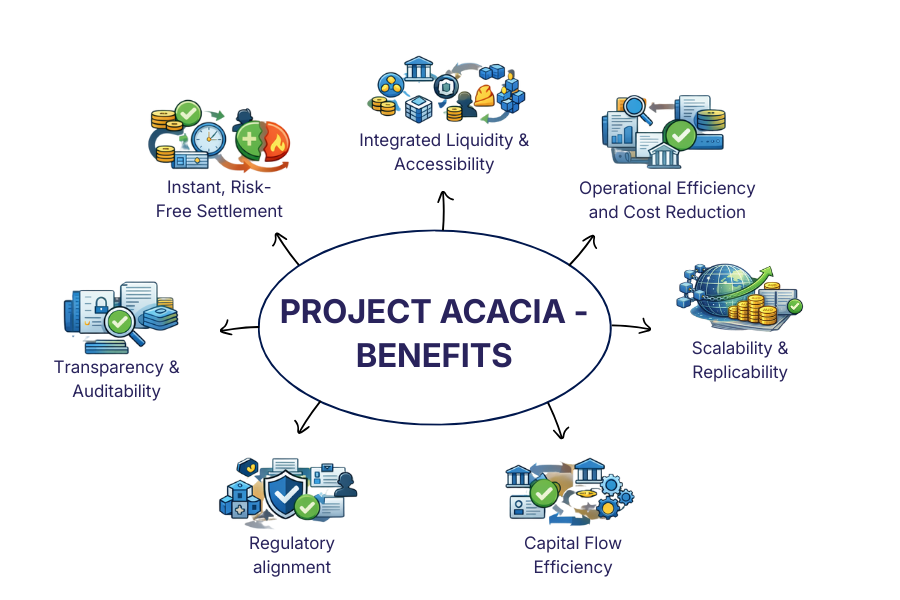

Benefits

Instant, Risk-Free Settlement – AUDM enables atomic delivery-versus-payment: when units are issued or traded, cash and tokens settle simultaneously. Counterparty and clearing risks are effectively eliminated.

Integrated Liquidity and Accessibility – Tokenised fund units can be exchanged freely on-chain through regulated trading venues, enabling near real-time settlement and freeing up capital for immediate redeployment. The structure allows for continuous trading, increasing accessibility.

Operational Efficiency and Cost Reduction – Smart contracts replace manual reconciliations, while on-chain ledgers provide immutable transaction records. Settlement, registry updates, and compliance checks occur programmatically, reducing administrative overhead and errors.

Transparency and Auditability – Every fund action (issuance, transfer, valuation update, or asset execution) is immutably logged. Trustees, auditors, and regulators can view the complete transaction history in real time. Investors view real-time holdings and net asset values, rather than waiting for periodic statements.

Regulatory Alignment – By embedding AFSL oversight, custody control, and KYC enforcement at the smart-contract level, Project Acacia maintains full compliance while adopting digital rails.

Capital Flow Efficiency – AUDM’s programmability supports automated treasury operations and instant capital deployment, ensuring that investor inflows are immediately productive within the fund’s mandate.

Scalability and Replicability – The Project Acacia model can be replicated across multiple funds and asset classes, allowing JellyC to tokenise a portfolio suite with shared settlement, registry, and compliance infrastructure.

Challenges

Regulatory Evolution – Continued collaboration with ASIC and Treasury will be necessary to refine custody and disclosure frameworks for digital fund units.

Data Latency and Validation – Maintaining millisecond-accurate NAVs across multiple exchanges and networks requires robust reconciliation and oracle governance.

Secondary Market Depth – Liquidity must mature to support institutional-scale trading volumes without volatility dislocation.

Operational Interoperability – Full automation depends on reliable API interconnections between banks, custodians, stablecoin issuers, and blockchain nodes.

Cyber and Key Security – Institutional custody protocols and multi-sig key management remain essential for safeguarding investor assets.

As a proof-of-concept, Project Acacia is purpose-built to validate each of these mechanisms, compliance, custody, execution, and secondary market integration under live conditions. The insights gained will directly inform JellyC’s broader rollout of institutional-grade tokenisation infrastructure.

The Road Ahead: JellyC’s Tokenisation Strategy

JellyC’s long-term strategy is to create an interoperable ecosystem of tokenised wholesale unit trusts, forming a network of digital-native investment vehicles with continuous liquidity and real-time valuation.

The roadmap includes:

Full Real-Time NAV (RTNAV) integration with automated rebalancing and execution.

Multi-asset tokenised portfolios, enabling seamless investor reallocation across funds.

Cross-fund liquidity pools, allowing dynamic capital movement between strategies.

Ongoing collaboration with Macropod, Redbelly, and Tokeniser to enhance interoperability, compliance automation, and scalability.

Through these developments, JellyC aims to establish itself as one of the first Australian managers to operationalise regulated fund tokenisation at an institutional scale, bridging traditional investment structures with digital financial infrastructure.

Conclusion: Building the Bridge Between Regulation and Innovation

Project Acacia represents a milestone in Australia’s transition toward regulated digital asset markets. It proves that tokenisation is not merely a technological concept but a practical advancement in fund operations, delivering higher transparency, speed, and investor trust within established legal boundaries.

By combining RTNAV automation, stablecoin settlement, secondary-market liquidity, and regulatory custody, JellyC and its partners are demonstrating how blockchain can be used to evolve, not replace, existing fiduciary systems.

Tokenisation will change the investor experience by embedding automation, transparency and liquidity directly into the investment instrument itself. For wholesale unit trust investors, this represents a shift from periodic statements, manual processes and illiquid lock-ups giving way to continuous engagement with transparent, programmable assets.

Project Acacia concludes as a demonstration of how a managed investment scheme can operate on-chain within Australia’s regulatory framework. Its success establishes the foundation for JellyC’s next phase: developing institutional-grade security and compliance, faster access to capital and enhanced transparency. Tokenisation infrastructure that extends beyond the pilot to support RTNAV, automated execution, and cross-fund interoperability will define the next generation of Australian wholesale investment management.

Disclaimer

This article ("Article") has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any financial product or service. This Article does not form part of any offer document issued by JellyC Pty Ltd (CAR Number 001293184), a corporate authorised representative of TAF Capital Pty Ltd (ACN 159 557 598, AFSL 425925). Past performance is not necessarily indicative of future results, and no person guarantees the performance of any financial product or service mentioned in this Article, nor the amount or timing of any return from it.

This material has been prepared for wholesale clients, as defined under Sections 761G and 761GA of the Corporations Act 2001 (Cth), and must not be construed as financial advice. Neither this Article nor any offer document issued by JellyC Pty Ltd or TAF Capital Pty Ltd takes into account your investment objectives, financial situation, or specific needs.

The information contained in this Article may not be reproduced, distributed, or disclosed, in whole or in part, without prior written consent from JellyC Pty Ltd. This Article has been prepared by JellyC Pty Ltd, which, along with its related parties, employees, and directors, makes no representation or warranty as to the accuracy or reliability of the information provided and accepts no liability for any reliance placed on it. Prospective investors should obtain and review the relevant offer documents before making any investment decision.