Top 5 predictions for 2026

After a transformative 2025 – marked by regulatory clarity, institutional adoption, and accelerating real-world use cases – the digital asset industry has crossed a critical threshold. Blockchain-based systems and transacting, corporates, sovereigns and treasuries investing in and holding digital assets - particularly stablecoins - are no longer fringe innovations and potential new systems; they are becoming core financial infrastructure and systems.

In 2025 alone:

Bitcoin reached a peak of ~USD 126,500

Ethereum traded just below USD 5,000

Spot Bitcoin ETFs peaked at USD 161bn in assets under management

Total stablecoin market capitalisation grew from ~USD 186bn to ~USD 300bn (over 50% growth in one year)

JellyC Chairman Drew Bradford and CEO Michael Prendiville believe that this growth and development will continue in 2026 as crypto and blockchain-based financial systems continue to mature and be widely adopted. Bradford and Prendiville sat down on Christmas Eve for a wide-ranging discussion on the sector, from which five key predictions and areas of focus emerged.:

1. Stablecoins continue to emerge as Core Financial Infrastructure with their compelling attributes of certainty, lower transacting costs and instant settlement

2026 will be the year stablecoins stop being described as “crypto products” and start being recognised as a financial system upgrade.

Following more than 50% growth in 2025, the global stablecoin market now sits at approximately USD 300bn, led by:

USDT: ~USD 187bn

USDC: ~USD 77bn

PYUSD: ~USD 3.8bn

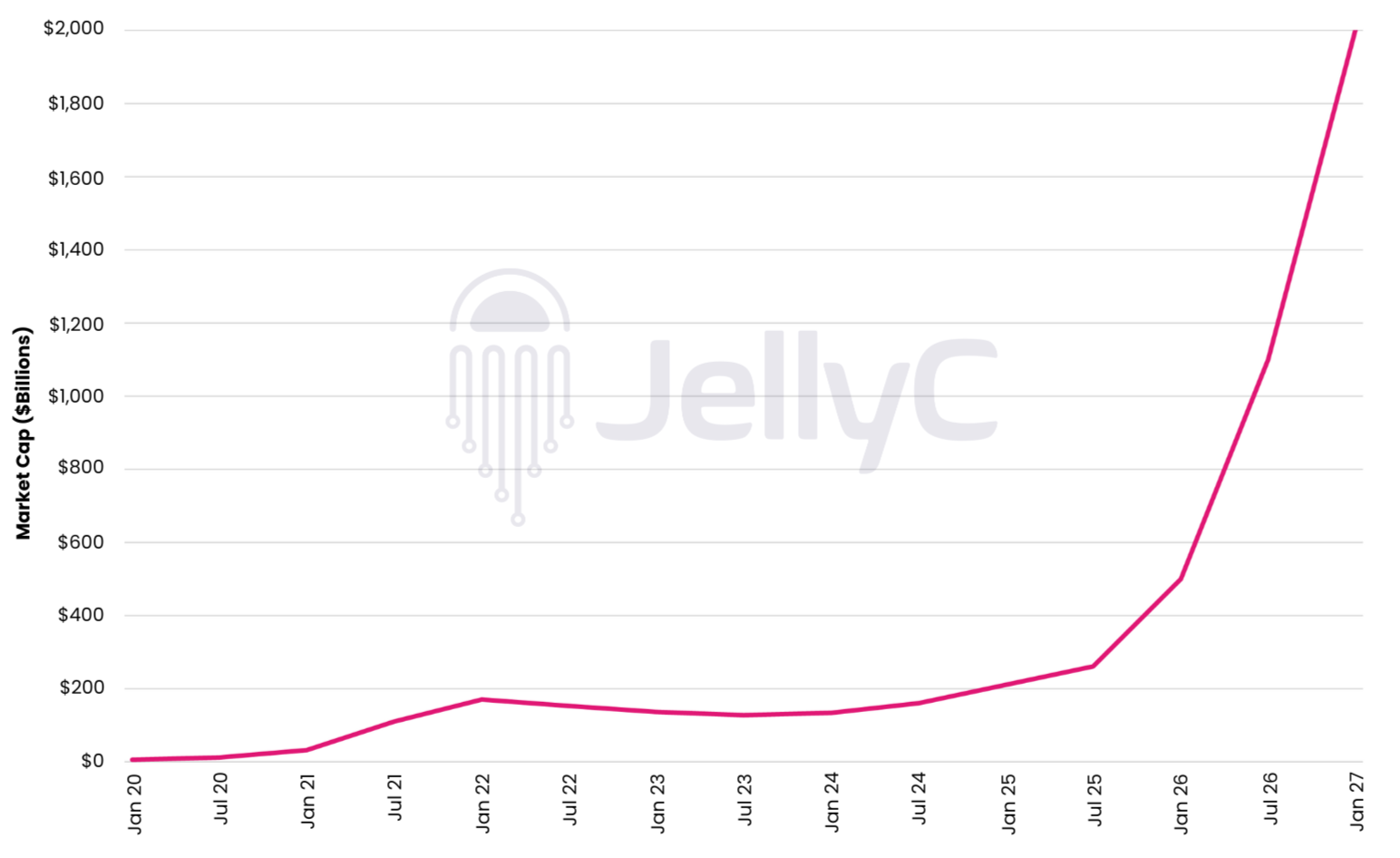

JellyC expects stablecoin market capitalisation to approach USD 2 trillion by Chinese New Year 2027, driven by payments, settlement, treasury management, and machine-to-machine transactions.

Forecasting stablecoin marketcap to $2T

“People won’t be talking about this as crypto anymore. They’ll just see it as a better financial system — one that settles instantly and actually works.” – Drew Bradford

Once institutions experience atomic settlement and institutional FX pricing, legacy banking rails become increasingly difficult to justify.

2. Non-USD Stablecoins Reach 20% of Global Volume, driven by widespread adoption in the Forex Market

While for now USD-denominated stablecoins still dominate, 2026 will see rapid growth in non-USD stablecoins, rising to approximately 20% of total global stablecoin volume - or more than $200 billion.

The key catalyst is foreign exchange.

Stablecoins already settle hundreds of billions of dollars per month, and enable:

Real-time cross-border settlement

Institutional (narrower) bid-offer FX pricing

Elimination of cut-off times and correspondent banking delays

“Foreign exchange is where this really breaks open. Once people realise they can convert and settle cross-border instantly, the logic is overwhelming.” – Drew Bradford

As this stablecoin adoption accelerates, exchanges and decentralised venues increasingly function as global FX markets, eroding the long-held monopoly of traditional banking rails.

3. Ethereum Outperforms Bitcoin as Utility Explodes through stablecoins, tokenisation and defi applications

Bitcoin remains the digital reserve asset. However, 2026 may well be the year Ethereum (the second-largest digital asset) outperforms Bitcoin on a relative basis.

More than 50% of global stablecoin volume already settles on Ethereum and its Layer-2 networks. At the same time:

Blackrock & others look to launch staked Ethereum ETFs in 2026

Institutional products such as tokenised money-market funds are increasingly built on Ethereum

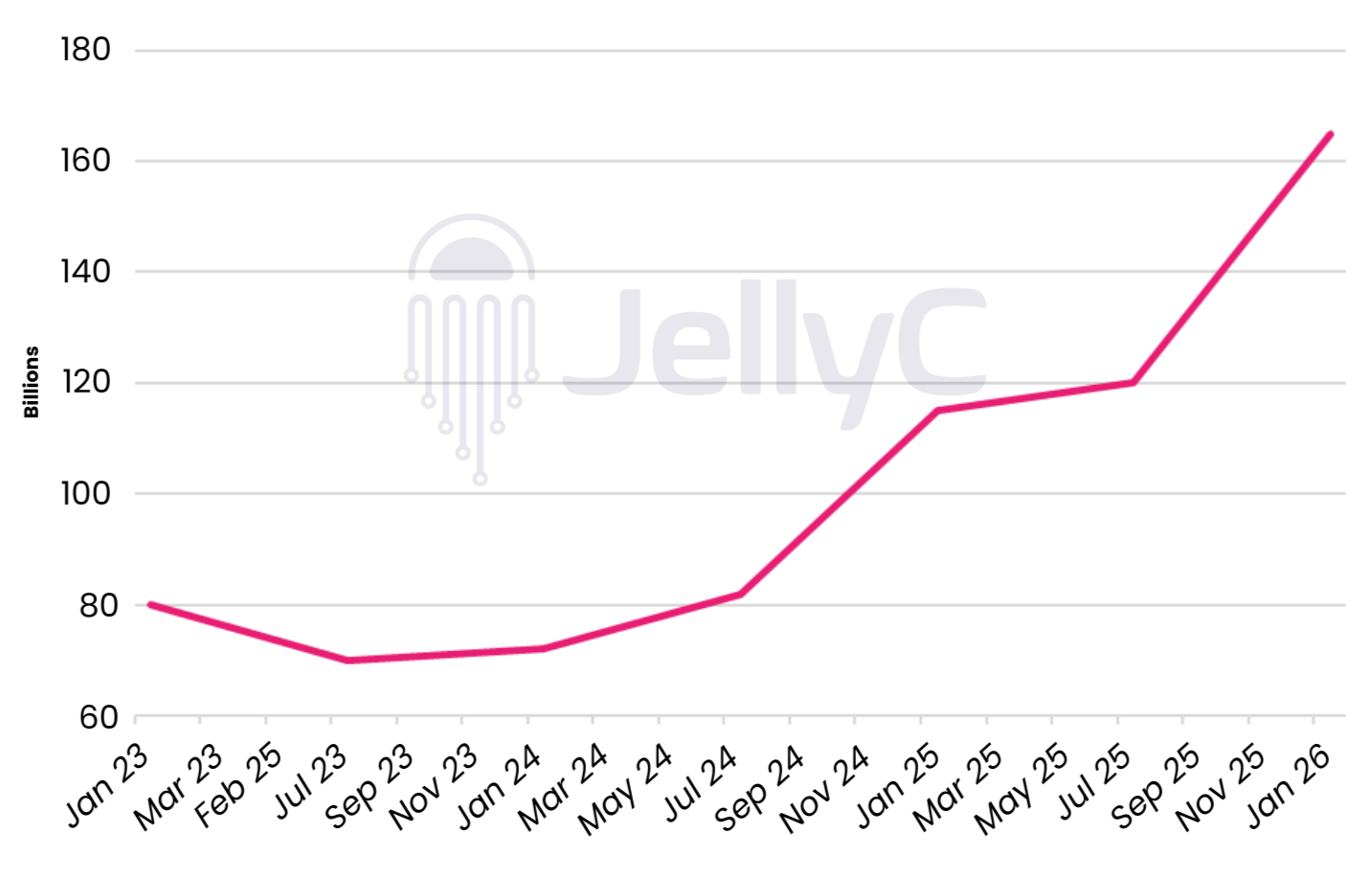

Stablecoins on Ethereum

As tokenised funds, stablecoins, and real-world assets scale, Ethereum becomes the transactional backbone of digital finance.

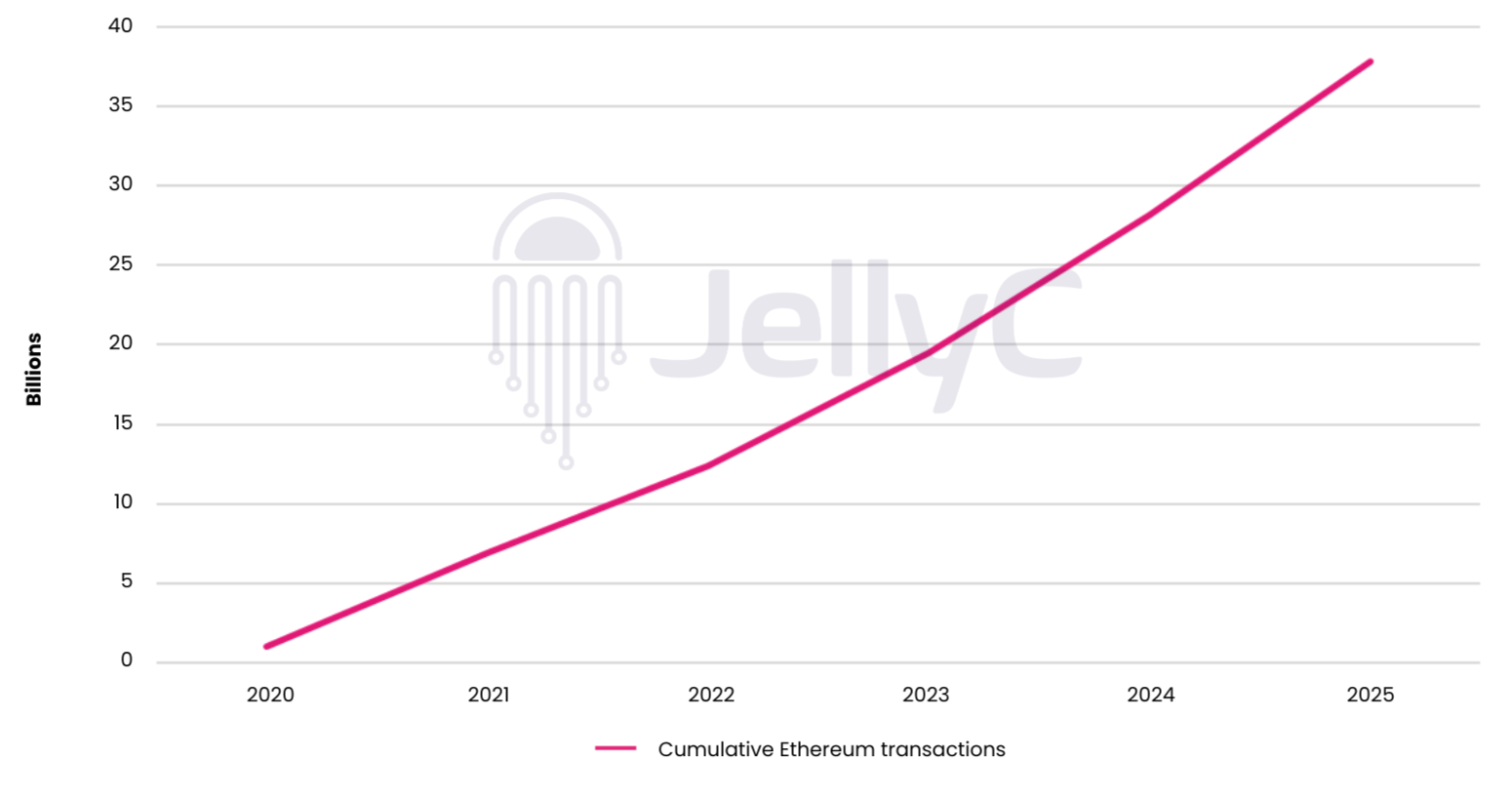

TPS of Ethereum Mainnet + L2s

“If you believe stablecoins grow to trillions, that settlement flow has to go somewhere — and a large part of it will move through Ethereum.” – Michael Prendiville

After years of infrastructure upgrades — lower fees, higher throughput, and Layer-2 scaling — Ethereum is positioned to capture sustained, utility-driven demand.

Cumulative Ethereum Transactions

4. Tokenisation of RWA, particularly investment and money funds, goes Mainstream

Tokenisation shifts from experimentation to production in 2026.

In 2025, major institutions, including BlackRock, JPMorgan, and Franklin Templeto,n launched tokenised money-market funds. For regulated managers, tokenisation must coexist with AML/CTF, KYC, and trustee oversight, creating a clear advantage for KYC-on-entry blockchain networks like Redbelly.

JellyC expects an increasing number of funds to:

Operate with live or near-real-time NAV

Maintain on-chain unit registers

Enable API-driven distribution

Reduce administration and operating costs

“Once a fund is tokenised, it becomes programmable. That changes distribution, reporting, and even how capital can be used as collateral.” – Michael Prendiville

This shift is no longer theoretical — it is already underway across institutional fund structures.

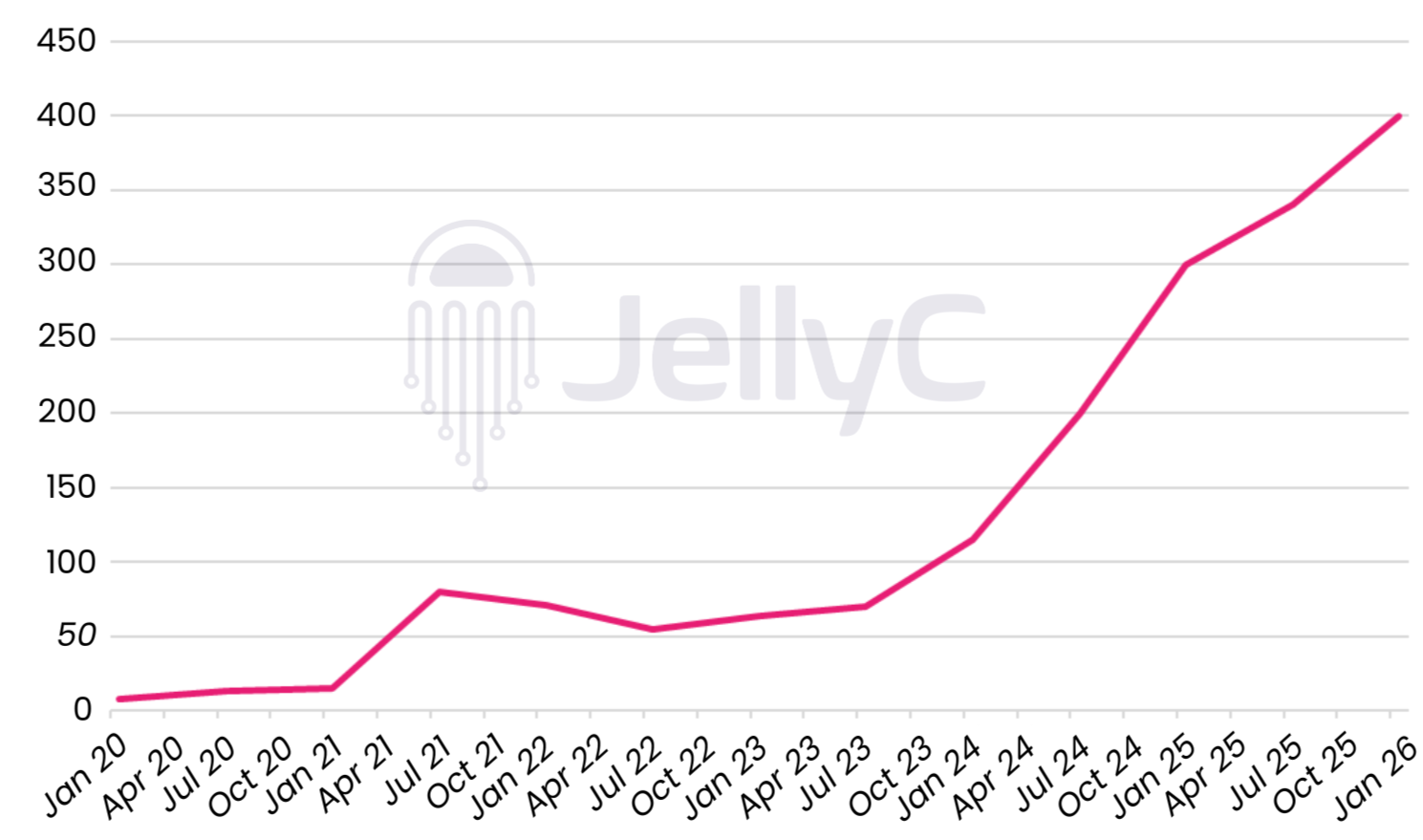

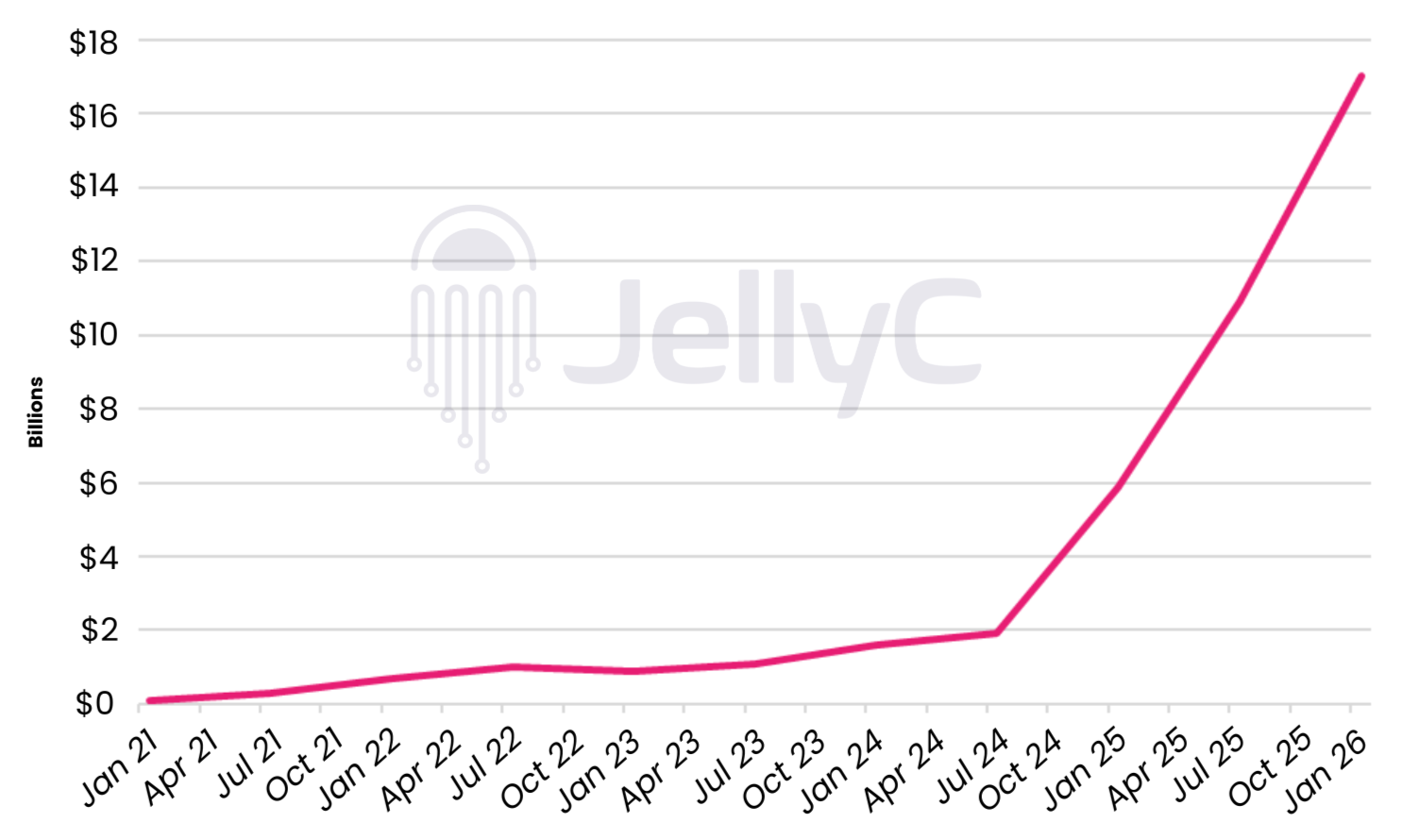

Market Cap of Tokenised Assets

5. Agentic Finance Accelerates

AI-driven capital flows reshape markets

2026 will be the breakout year for agentic finance – AI-driven systems executing trades, managing treasury flows, and routing liquidity autonomously across centralised and decentralised venues.

Stablecoins provide the fuel. While market capitalisation attracts headlines, it is transaction volume that will surge — particularly as:

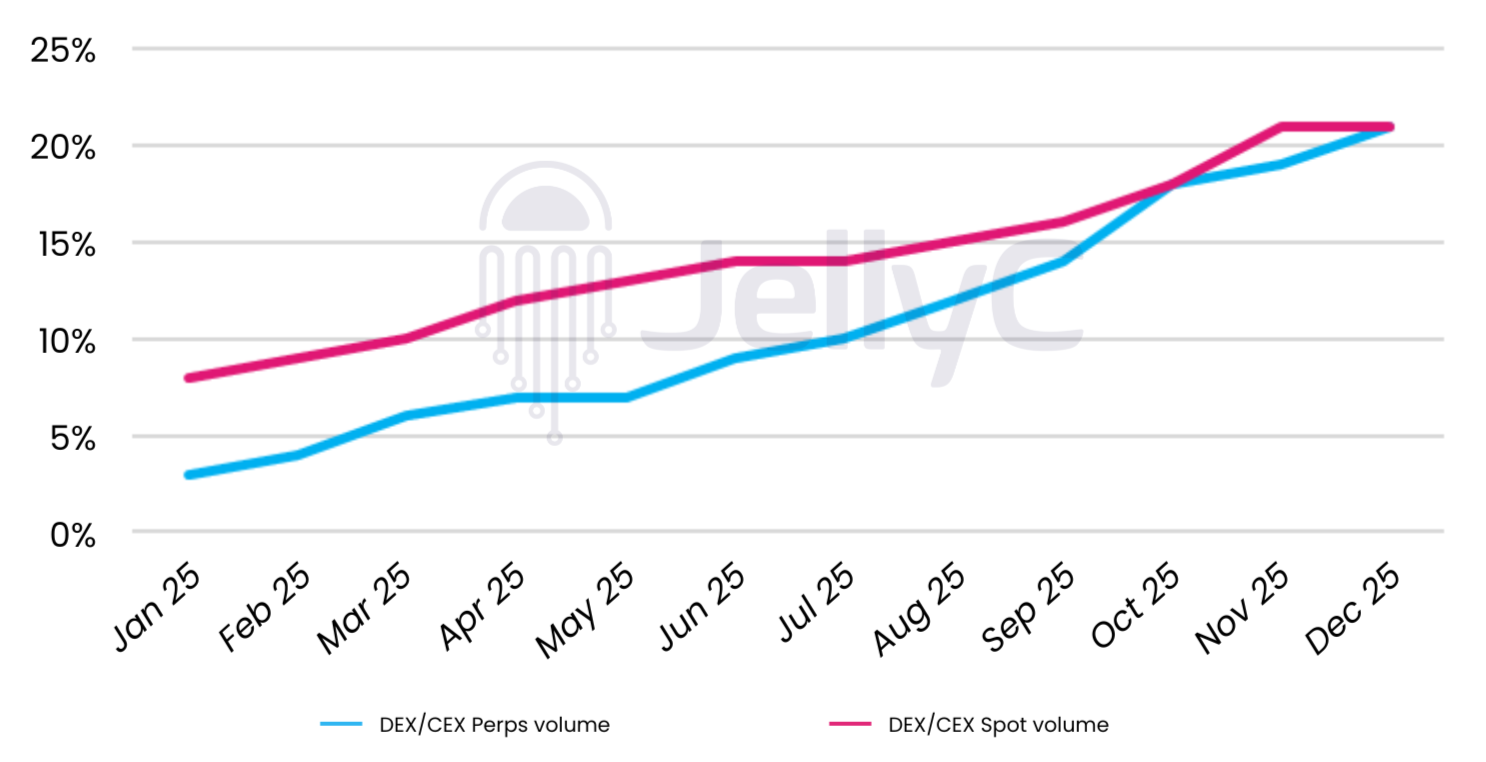

DEXs already account for ~21% of global spot trading volume

Autonomous strategies increasingly operate 24/7 across chains

However, increased automation also introduces new risks. Poorly designed agents, weak governance frameworks, and inadequate controls create opportunities for market abuse, operational failures, and unintended losses — particularly as strategies scale.

DEX/CEX trading volume in 2025

“Agentic flow will grow quickly, but people need to be careful. Poorly designed agents and weak governance will lead to losses.” – Michael Prendiville

In this environment, competitive advantage will shift from speed alone to governed automation. The winners will be platforms and asset managers that combine AI-driven execution with robust risk controls, auditability, and human oversight — treating agentic systems not as shortcuts, but as regulated financial infrastructure.

Disclaimer

This article ("Article") has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any financial product or service. This Article does not form part of any offer document issued by JellyC Pty Ltd (CAR Number 001293184), a corporate authorised representative of TAF Capital Pty Ltd (ACN 159 557 598, AFSL 425925). Past performance is not necessarily indicative of future results, and no person guarantees the performance of any financial product or service mentioned in this Article, nor the amount or timing of any return from it.

This material has been prepared for wholesale clients, as defined under Sections 761G and 761GA of the Corporations Act 2001 (Cth), and must not be construed as financial advice. Neither this Article nor any offer document issued by JellyC Pty Ltd or TAF Capital Pty Ltd takes into account your investment objectives, financial situation, or specific needs.

The information contained in this Article may not be reproduced, distributed, or disclosed, in whole or in part, without prior written consent from JellyC Pty Ltd. This Article has been prepared by JellyC Pty Ltd, which, along with its related parties, employees, and directors, makes no representation or warranty as to the accuracy or reliability of the information provided and accepts no liability for any reliance placed on it. Prospective investors should obtain and review the relevant offer documents before making any investment decision.