JellyC’s Market Neutral Fund delivers steady, reliable returns through crypto market cycles

Edited by Michael Prendiville and Nick Mace

Market-neutral hedge funds are designed to generate steady returns, regardless of market direction. These funds use various strategies to generate positive returns in a way that is not betting on the overall market direction. Market-neutral strategies, well established in TradFi, are particularly well suited to digital assets given the volatility and fragmentation.

JellyC's Bluebottle Market Neutral Fund (BMN) is a digital asset hedge fund drawing on JellyC's combined +150 years of TradFi experience. By deploying this depth of experience into digital asset markets, investors have the opportunity to earn consistent, reliable returns through volatile digital asset cycles.

The BMN is a wholesale investment vehicle managed by JellyC. The fund targets returns by blending multiple income-focused strategies with allocations to stable digital asset instruments. The BMN maintains very low net market exposure, balancing long and short positions across a range of digital assets to neutralise the impact of rising or falling crypto prices on overall fund performance.

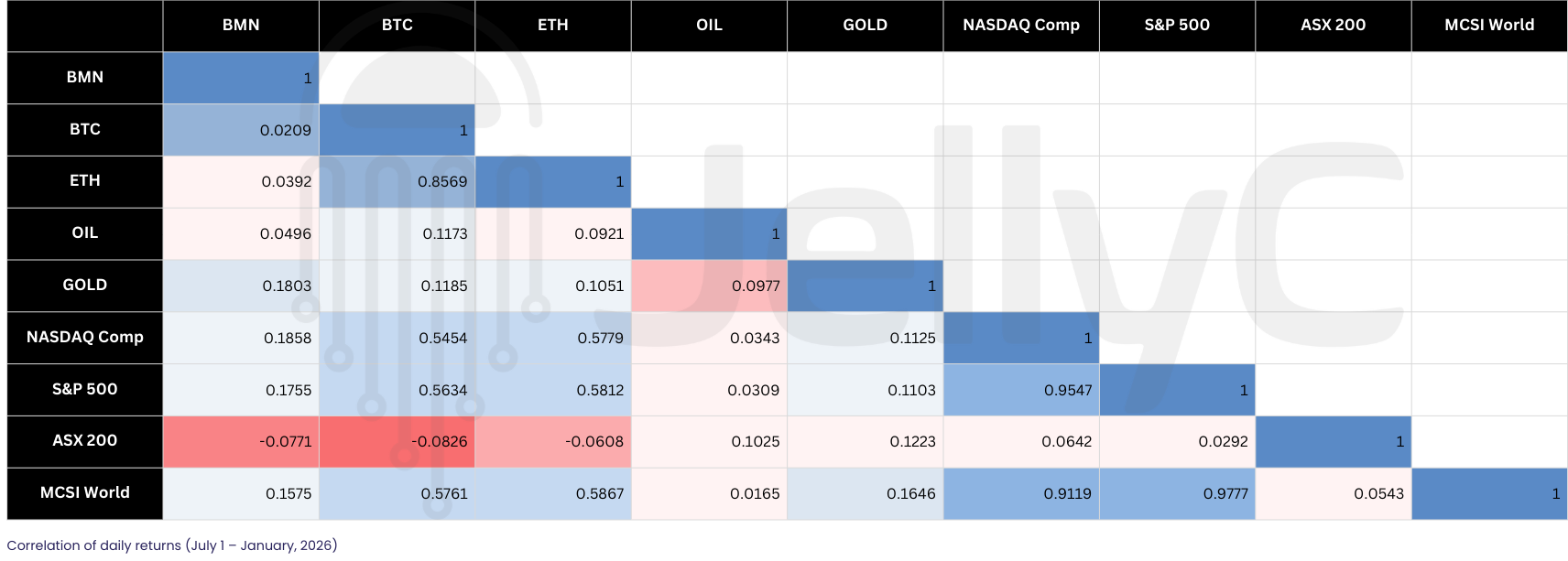

BMN Correlation Matrix

The Fund employs a range of strategies, including:

Arbitrage: capturing price discrepancies across exchanges and instruments.

Price-making: earning bid-ask spreads through liquidity provision.

Basis trading and funding-rate capture: exploiting spreads between spot, futures, and perpetual markets.

Hedged staking and lending: generating yield from staking and lending protocols while hedging directional risk of the underlying crypto asset.

Tokenised fixed-income assets: allocating to tokenised money-market funds, bonds, and cash-like deposits to provide stable yield and portfolio ballast.

The fund prioritises consistent income generation and risk-adjusted returns over concentrated exposure to any single digital asset or reliance on speculative rallies. The strategy targets 10–15% per annum returns. It emphasises income generation over capital gains by blending yield-bearing strategies across the portfolio. Derivatives are employed for hedging and return enhancement, with selective leverage used to improve capital efficiency.

JellyC acquired Trovio Asset Management in October 2024, and put the BMN (previously DAF) into care and maintenance. In July 2025, the Fund completed a major infrastructure upgrade, refining its market-neutral strategies and expanding the portfolio’s yield-generating capabilities. This was further strengthened through an institutional-grade collateral mirroring program established with Franklin Templeton, Standard Chartered, and OKX, enabling more capital-efficient execution across venues.

Institutional-grade custodial and settlement providers, including Zodia Custody, Fireblocks, Coinbase, and Standard Chartered support the Fund’s operations.

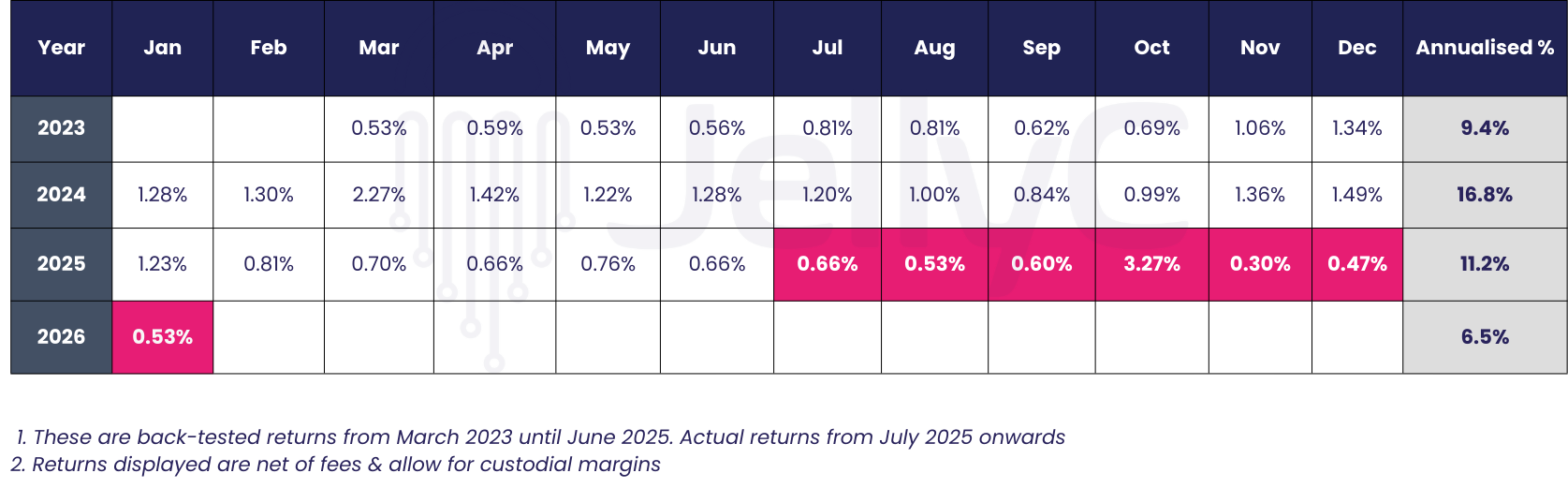

In its first six months, the BMN returned 6.75% (13.5% annualised) before fees, vs Bitcoin's dramatic decline of 30%. Thus validating the restructured strategy across challenging market conditions.

Crucially, the fund has not had a down month since its relaunch.

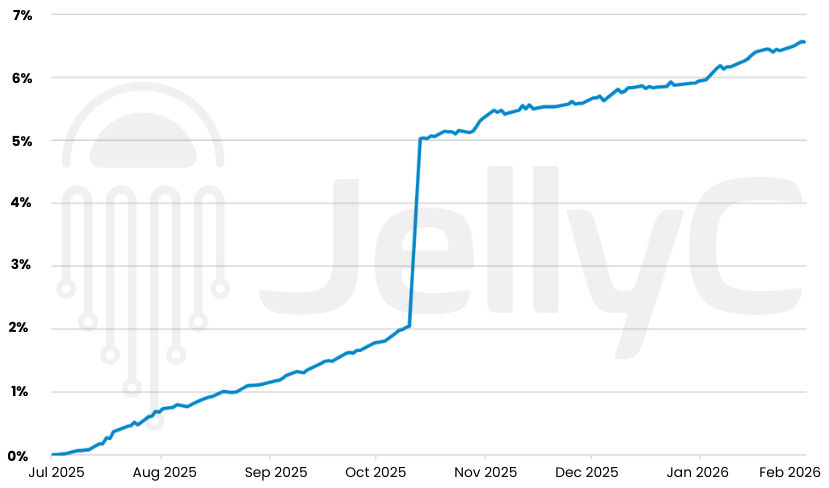

Daily Returns After Fees

This early track record supports the fund's core objective of delivering consistent, positive returns within a disciplined risk-management framework, through all phases of the digital asset cycle.

Monthy & Annual Returns After Fees

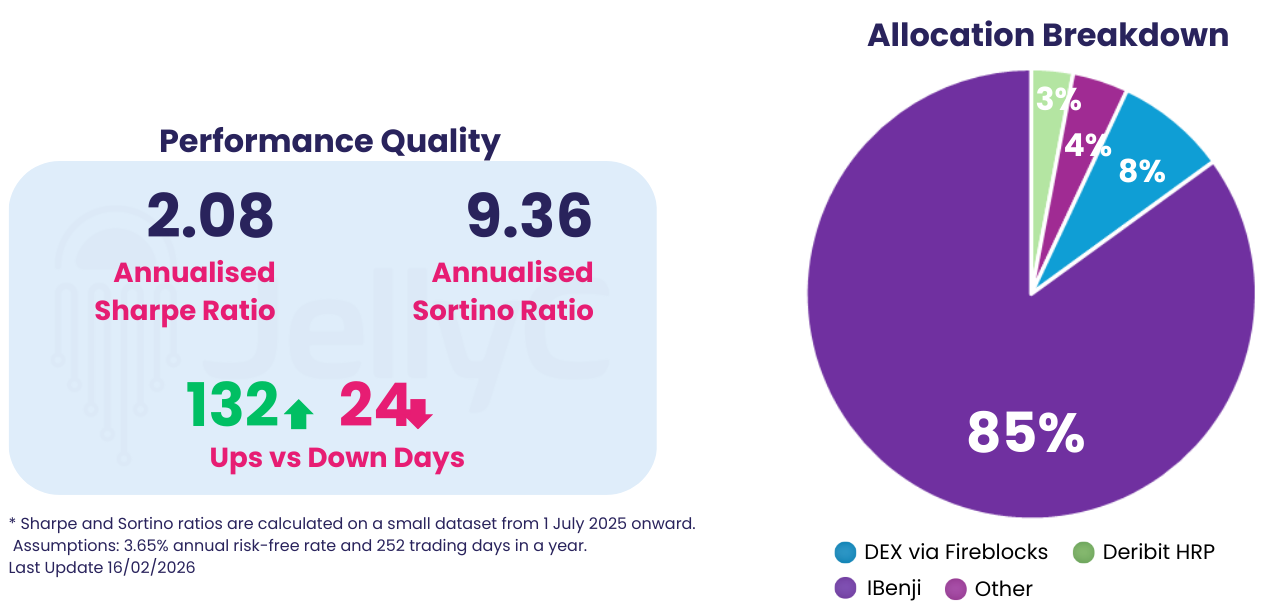

A hallmark of the BMN is the emphasis on downside protection. During the second half of 2025, the fund delivered a Sortino Ratio of 9.5 up until the end of December. This is well above the 3.0 threshold generally considered excellent, reflecting minimal downside volatility relative to returns. Since the fund's restructuring, the maximum daily drawdown has been just -0.06%. This daily/monthly performance profile illustrates a stable, income-oriented return stream designed to compound steadily through market cycles.

The BMN represents JellyC's commitment to bringing a mature, disciplined market-neutral approach to digital assets. Thereby delivering predictable, income-focused returns while limiting downside exposure across every phase of the market cycle.

If that's not enough, the team at JellyC are weeks away from fully tokenising the BMN. This means that investors will have access to a high yielding, low volatility fund with a live unit price, 24/7.

Disclaimer

This article ("Article") has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any financial product or service. This Article does not form part of any offer document issued by JellyC Pty Ltd (CAR Number 001293184), a corporate authorised representative of TAF Capital Pty Ltd (ACN 159 557 598, AFSL 425925). Past performance is not necessarily indicative of future results, and no person guarantees the performance of any financial product or service mentioned in this Article, nor the amount or timing of any return from it.

This material has been prepared for wholesale clients, as defined under Sections 761G and 761GA of the Corporations Act 2001 (Cth), and must not be construed as financial advice. Neither this Article nor any offer document issued by JellyC Pty Ltd or TAF Capital Pty Ltd takes into account your investment objectives, financial situation, or specific needs.

The information contained in this Article may not be reproduced, distributed, or disclosed, in whole or in part, without prior written consent from JellyC Pty Ltd. This Article has been prepared by JellyC Pty Ltd, which, along with its related parties, employees, and directors, makes no representation or warranty as to the accuracy or reliability of the information provided and accepts no liability for any reliance placed on it. Prospective investors should obtain and review the relevant offer documents before making any investment decision.